Credit Unions

Using Due Diligence To Select and Manage Vendor Relationships

Due diligence should be tailored to the importance of the third-party relationship. Certainly not every vendor demands the same level, and tailored for the complexity of the vendors product or service. More complex relationships require a wider breadth of due diligence and requires deeper digging. “Risk” profile should be carefully …

Credit Unions: Building a Vendor Management Plan

This applies as you consider what you really want from your overall Vendor Management Plan. To illustrate the point, I will use a comparison of building a house and building your Vendor Management Plan. PLANNING Much the way an architect draws up a plan for a house, you will need …

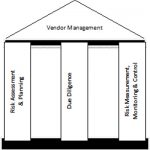

4 Parts of Vendor Management

The term vendor management is used to describe the activities in researching and sourcing vendor services. This may but not limited to, quotes with pricing, turnaround times, capabilities, and quality of work, negotiating contracts, managing relationships, assigning jobs, evaluating performance, and ensuring payments are made. It requires a lot of …

Using Vendor Management to Define Vendor Risk for Credit Unions

Defining the importance of a vendor is important to any financial institution especially credit unions. Oversight and due diligence must be performed on a regular basis, and certainly much more on critical vendors. What group does that make up? Core processors, statement printing companies, check processors. Anything to do with …

Part II – 3 More Ways to Strengthen Your Credit Union Vendor Management

Last week, we gave you three ways to strengthen credit union’s vendor management program. Today, we will give you the other three. Board of Director Involvement All successful outsourced relationships starts with having involvement from the Board of Directors and senior management. It typically starts with Information Security Officer (ISO) …

Part I – 3 Ways to Strengthen Your Credit Union Vendor Management

This is the first of two articles that addresses vendor management and how to strengthen the relationships you have with them. Credit unions rely on third-party providers to offer specialized services and technology assistance to help keep operations running without a hitch. Improving quality and overall efficiency should be a …

What is Vendor Management?

You probably already know that vendors can provide just about any kind of good or service to your company. A vendor can come from any business vertical; credit unions, banks, contractor, creative, manufacturer, or anyone else who fills a need that you and your employees don’t create or provide in …

Vendor Management: What the NCUA Requires

The NCUA requires credit unions to be cognizant of a few requirements to manage vendor relationships. The NCUA outlines its expectations in Supervisory Letter No.: 07-01, Evaluating Third Party Relationships. Its guidance is based on three key concepts: Risk assessment and planning, Due diligence, and Risk measurement, monitoring and control. KEY …

FedComp and Venminder Forge Partnership

The Virginia-based FedComp, and Venminder — a software and personnel provider for financial institutions and credit unions around the nation — have partnered up to increase vendor relations with its clients. The partnership is designed to offer more competitive pricing to its growing clientele. FedComp is most known for its …

Credit Union of Ohio Switch to New Platform

The Credit Union of Ohio has decided to up its core processing system to a platform owned by Corelation Inc. This switch will help the Hillard, Ohio-based company automate manual vendor processes. Corelation Inc. provides service technology to credit unions. The Credit Union of Ohio has decided to take on …